SEI Stability and Dynamic ETF Strategies tactical asset allocation changes

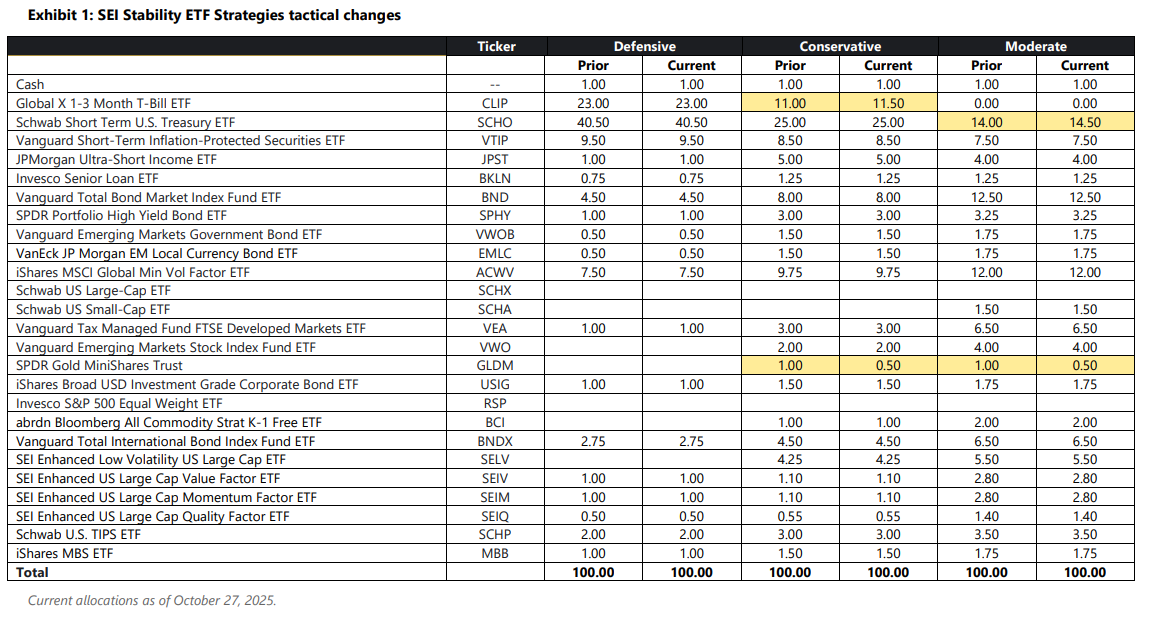

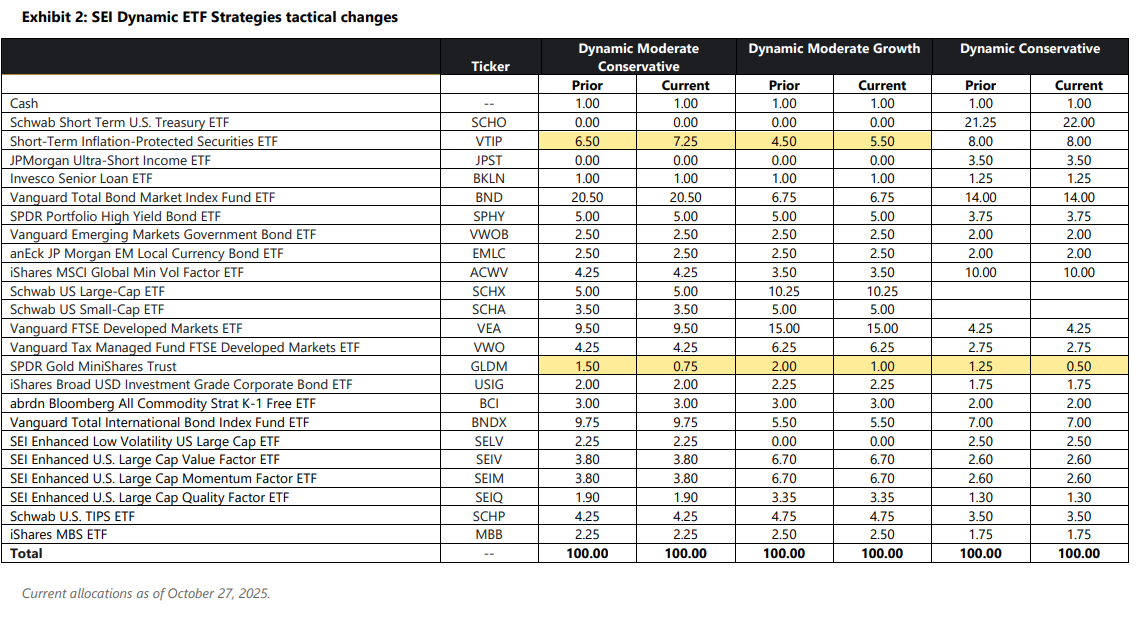

We trimmed a position in gold.

Background:

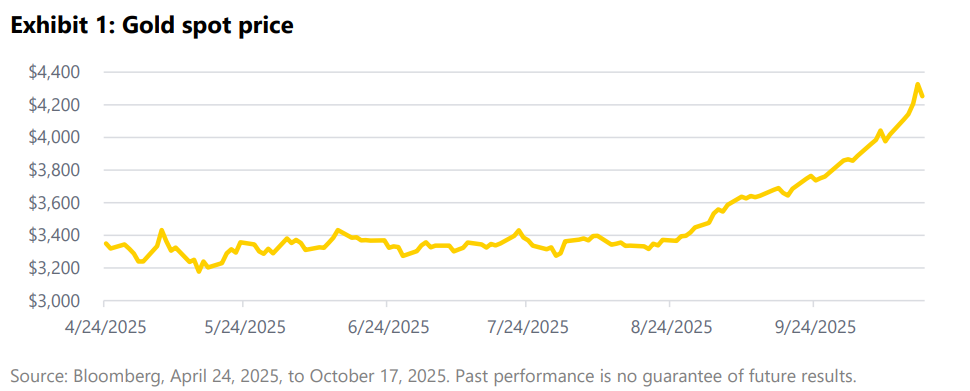

We recently trimmed our active allocation to gold. While we continue to believe gold presents an interesting active opportunity, we are taking profits after the recent surge in price that occurred after we added to the position in early September. Regardless of recent frothiness in the gold market, we believe that structural drivers remain, which include:

• Ongoing central bank purchases

• Continued net inflows to gold ETFs

• Increased hedging demand in the face of global trade and recession risks

These factors were heightened at the time by the emergence of a general de-dollarization—or at least a weaker U.S. dollar—theme. We believe the most recent leg of appreciation in the gold price may not be entirely explained by fundamentals but could rather be principally driven by retail flows suggesting an element of FOMO (fear of missing out). For this reason, we have decided to take profits on our gold position.

Important information

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the portfolios or any stock in particular, nor should it be construed as a recommendation to purchase or sell a security, including futures contracts. There is no assurance as of the date of this material that the securities mentioned remain in or out of SEI portfolios.

Investing involves risk, including possible loss of principal. There is no assurance that the objectives of any strategy or fund will be achieved or will be successful. No investment strategy, including diversification, can protect against market risk or loss. Holdings subject to change.

Consider the Strategy’s investment objectives, risks, charges and expenses carefully before investing. The Strategies invest in exchanged-traded products (ETPs) to obtain the desired exposure to an asset class. A copy of each ETPs prospectus is available upon request. The prospectus includes information concerning each fund’s investment objective, strategies and risks.

The funds in the Strategy are subject to tracking error risk, or the risk that the fund’s performance may vary substantially from the performance of the index it tracks as a result of cash flows, expenses, imperfect correlation between the fund and the index and other factors. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Narrowly focused investments and smaller companies typically exhibit higher volatility. Bonds and bond funds will decrease in value as interest-rates rise. High-yield bonds involve greater risks of default or downgrade and are more volatile than investment-grade securities, due to the speculative nature of their investments. TIPS can provide investors a hedge against inflation, as the inflation adjustment feature helps preserve the purchasing power of the investment. Because of this inflation adjustment feature, inflation protected bonds typically have lower yields than conventional fixed-rate bonds and will likely decline in price during periods of deflation, which could result in losses. Commodity investments may be more volatile and less liquid than direct investments in the underlying commodities themselves. Commodity related equity returns can also be affected by the issuer's financial structure or the performance of unrelated businesses.

Underlying ETFs may also utilize leverage, including inverse leverage. Leveraged ETFs seek to deliver multiples of the performance of the index or benchmark they track. Inverse ETFs seek to deliver multiples of opposite of the performance of the index or benchmark they track. The use of leverage can amplify the effects of market volatility on the underlying ETF's share price. Leveraged ETFs are generally managed with a goal to seek a return tied or correlated to a specific index or other benchmark (target) as measured only with respect to a single day (i.e., from one NAV calculation to the next). Due to the compounding of daily returns, the returns of such leveraged ETFs over periods other than one day will likely differ in amount and possibly direction from the target return for the same period. These effects may be more pronounced over longer holding periods, in funds with larger or inverse multiples and in funds with volatile benchmarks.

SEI Investments Management Corporation (SIMC) is the adviser to the SEI Stability ETF and Dynamic ETF Strategies. SIMC is a wholly-owned subsidiary of SEI Investments Company (SEI)