Asset allocation changes to U.S. Target Date Funds.

The Investment Management Unit’s Advice team made strategic glide-path allocation adjustments to SEI’s U.S. Target Date Funds (the Funds). These updates are designed to adjust the exposures of each Fund in order to keep its asset mix aligned with its intended annual glide path. As participants age, fund allocations move along the glide path, becoming more conservative as the target date approaches. Typically, glide-path adjustments are accomplished by decreasing the equity allocation and increasing the fixed-income allocation.

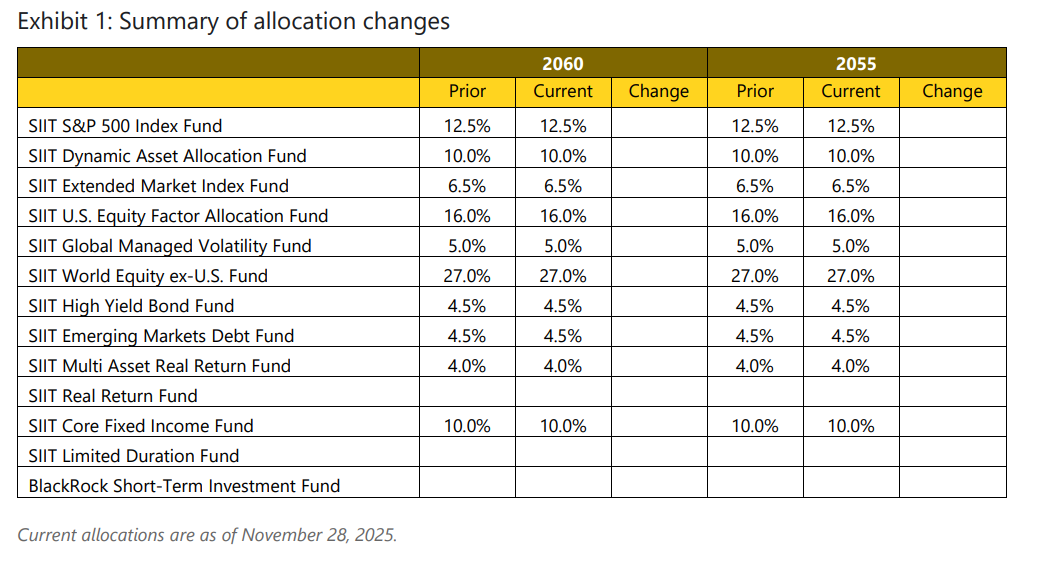

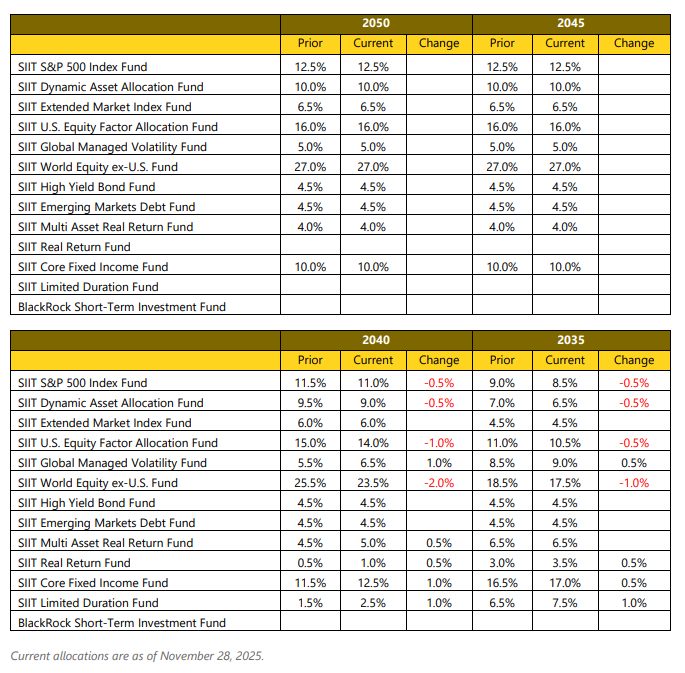

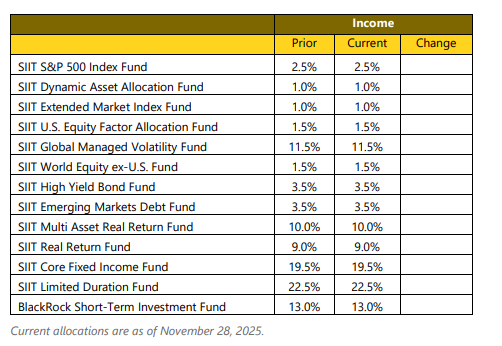

The changes for each Fund are detailed in the following tables, which show current allocations—including tactical shifts—and are accompanied by the supporting rationale.

Important information

As identified in the presentation, certain funds are collective trust funds, not mutual funds. A collective trust fund is an investment fund that is maintained by a bank or trust company for the collective investment of qualified retirement plans and governmental plans, and that is exempt from SEC registration as an investment company under Section 3(c)(11) of the Investment Company Act of 1940. Collective trust funds eliminate many of the administrative costs associated with institutional and retail mutual funds.

The collective investment trusts identified in this presentation are managed by SEI Trust Company (STC), the trustee, based on the investment advice of one or more third party managers, which may include SEI Investments Management Corporation (SIMC). STC is also a wholly owned subsidiary of SEI Investments Company.

For more information on the collective trust funds, including fees and expenses, please read the disclosure document for the trust.

There is no guarantee that the investment objective will be fulfilled. If the fund is a target date fund, the principal balance of the portfolio may be depleted prior to a portfolio’s target end-date and, therefore, distributions may end earlier than expected. This risk increases if the distribution amount chosen is a significant portion of the starting principal. The target date represents the respective date when an investor intends to withdraw funds for retirement. Principal of any target date fund is not guaranteed at any time, including the target date. The projected time periods do not take into account the payment of fees to the advisor out of the portfolio or any other additional distribution from the account.