Do you know SEI? You should.

SEI doesn't follow trends, we seek to stay ahead of them.

- 1980s

- 1990s

- 2000s

- 2010s

-

1980s

Strategic Asset Allocation

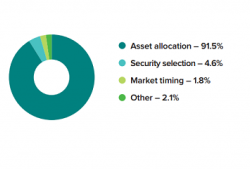

Brinson and Hood, along with Beebower, an SEI employee, determined that asset allocation, not securities selection, drives 91% of variation in return.

-

1990s

Manager of Managers

SEI was one of the first companies to offer manager-of-managers investment programs to both institutional and individual investors. We believe this approach results in better risk management and a more cost-effective implementation.

-

2000s

Goals-Based Investing

SEI was one of the first to integrate traditional and behavioral finance to clarify focus on investor goals. Our goals-based solutions have been available in the U.S. since 2004 and boast over $15 billion AUM globally

Managed Volatility

SEI partnered with six leading investment firms to test strategies that manage absolute rather than relative risk. SEI's U.S. Managed Volatility Fund was one of the first of its kind, launched in November 2004. The Fund has since been joined by four other SEI Managed Volatility funds globally, all of which are used in SEI's Goals-based solution

-

2010s

Objective-Based Investing

Objective-based investing in SEI's multi-asset strategies goes beyond the traditional stocks, bonds and cash approach in an effort to enable investors to consistently meet specific objectives with an appropriate level of risk